- Introduction

- What is Compounding and How it Works?

- The Formula for Compound Interest

- Why Compounding is Powerful?

- Power of Time on Compounding

- The Rule of 72

- Compounding Can Occur In Many Types of Investment

- The Role of Risk in Compounding

- The Effect of Inflation on Compounding

- Practical Tips for Harnessing the Power of Compounding

- Conclusion

Introduction

Compounding might sound complicated, but it’s pretty simple and super powerful! Imagine you have some money saved up, and every year, it earns a little bit more. Now, not only does your original money grow, but the new money you earned also starts earning more money! Over time, this growth adds up quickly. It’s like planting a tiny seed and watching it grow into a huge tree. The earlier you start, the bigger your tree can grow, thanks to the magic of compounding. In this guide, we’ll cover:

- What compounding is and how it works

- Why compounding is powerful

- The Power of Time on Compounding

- How to calculate compound interest

- Examples of compounding in action

- Tips for maximizing the power of compounding

Let’s dive in and see how this can make your money grow like magic!

What is Compounding and How it Works?

Compounding is like a money-growing machine! When you invest some money, and it earns more money, you can reinvest those earnings. This way, your money starts earning on top of the money it already made. For example, if you invest $1,000 at 5% interest, you’ll earn $50 in the first year. In the second year, instead of earning interest only on your $1,000, you’ll earn it on $1,050. As you keep reinvesting, your money grows faster and faster, just like a snowball rolling downhill!

To really get how compounding works, you need to know three key things:- the amount you start with, the interest rate, and how long you invest.

- Starting Amount: The more you put in at the beginning, the more you can earn over time. Even small amounts can grow big if, over the years, you give them time. So, by starting early and staying consistent, you can really see your money multiply!

- Interest Rate: Higher rates mean your money grows faster. The more interest, the quicker your money piles up. For example, an 8% interest rate could make your money faster than 6%.

- Time: The longer you leave your money invested, the more it grows. Starting early is a big advantage because time boosts compounding!

The Formula for Compound Interest

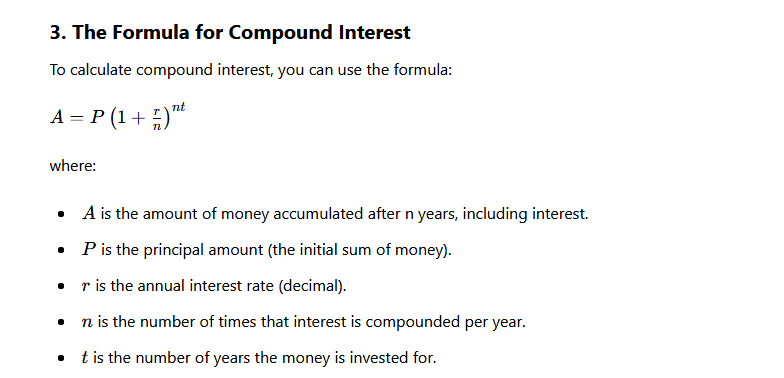

To calculate compound interest, you can use the formula:

Why Compounding is Powerful?

Compounding comes with some pretty awesome benefits:

- Faster Growth: Unlike simple interest, which only adds up slowly, compound interest helps your money grow much faster over time.

- Building Wealth: The longer you keep your money invested, the more it can grow. Therefore, compounding is great for long-term goals.

- Passive Income: Your money starts working for you, earning more without you having to do much at all! It’s like having little money helpers that keep adding to your savings while you’re busy with other things. The best part is, the longer you let your money work, the more it grows on its own. So, by being patient, you can reach your financial goals with hardly any extra effort!

- Retirement Savings: Starting early with compounding can really give your retirement savings a big boost, helping you feel more secure about your future. The sooner you start, the more time your money has to grow. Even if you only save a little at first, it can add up to a lot over time. Plus, by keeping up with regular contributions, you’ll be in a better position to enjoy a comfortable retirement when the time comes.

Power of Time on Compounding

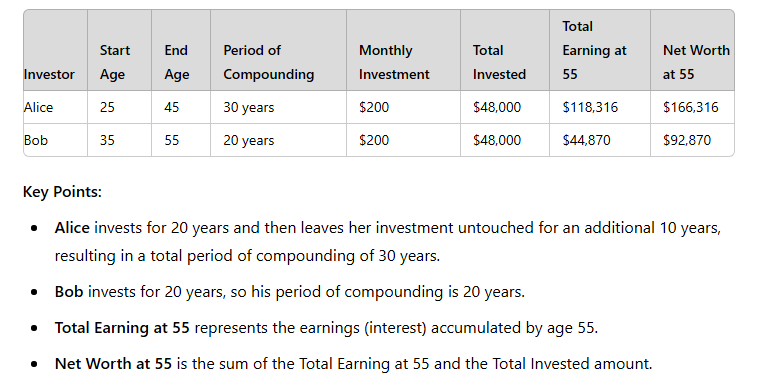

Time is super important when it comes to compounding. The sooner you start investing, the more time your money has to grow. Even if you invest just a little bit regularly, over a long period, it can turn into something big. So, starting early really pays off!

For example, consider two individuals: Alice and Bob. Alice starts investing $200 per month at the age of 25, while Bob starts investing the same amount at the age of 35. Both investments earn an annual return of 6%. They stop investing after 20 years. Alice is 45 years old when she stops investing while Bob is 55. They both invested $48,000.

At 55 years of age, Bob made an earning of $44,870, and his net worth is $ 92, 870. Alice, at 55 years earns $118,316, and her net worth is $166,316. Due to the extra decade of compounding, Alice’s investment will be worth significantly more than Bob’s, even though they invested the same amount.

The Rule of 72

The Rule of 72 helps you quickly estimate how long it will take for your investment to double. Just divide 72 by your annual interest rate. For instance, a 6% interest rate means your investment could double in about 12 years.

Compounding Can Occur In Many Types of Investment

Compounding can happen in many types of investments:

- Savings Accounts: Even though the interest is low, your money can still grow over time with compounding.

- Stocks: You can earn through price increases and dividends. For example, reinvesting dividends makes your money grow faster by the power of compounding.

- Bonds: These give you regular interest payments that can be reinvested to take advantage of compounding.

- Mutual Funds: By pooling money with others and reinvesting the earnings, you can see significant growth.

- Retirement Accounts: Accounts like 401(k)s, IRAs, PPFs, and EPFs benefit greatly from compounding, especially if you contribute regularly.

The Role of Risk in Compounding

Risk plays a big role in how compounding works. While compounding can help grow your money, the amount you earn depends on the level of risk you’re willing to take. Higher returns usually mean higher risk, which could lead to losing money. That’s why it’s important to spread out your investments (called diversifying) and know how much risk you’re comfortable with. This way, you can take advantage of compounding while also protecting yourself from big losses.

The Effect of Inflation on Compounding

Inflation can erode the real value of your investment returns. While compounding grows your money, inflation can reduce its purchasing power. To counter inflation, invest in assets that historically outpace inflation, such as stocks or real estate.

Practical Tips for Harnessing the Power of Compounding

To maximize the benefits of compounding:

- Start Early: Start investing in investment assets as soon as possible to take advantage of long-term growth.

- Invest Regularly: Consistent investments, even small ones, can grow significantly over time.

- Reinvest Earnings: Reinvest dividends, interest, and capital gains to enhance compounding.

- Be Patient: Compounding takes time. So, stay invested and avoid making decisions based on short-term market fluctuations.

- Diversify Investments: Spread your investments across different asset classes to manage risk and benefit from various growth opportunities because diversification is a key component of smart financial planning.

Conclusion

The power of compounding is like a financial superpower that can help you build a lot of wealth over time. By understanding how it works and using it wisely, you can boost your financial growth and reach your long-term goals. The secret to successful compounding is to start early, keep investing regularly, and be patient. So, start now, stick with it, and watch your money grow over time!

Disclaimer:

The information provided in this document is for educational purposes only and does not constitute financial advice.