Introduction

Are you looking for a simple way to start investing your money? Well, index funds investing could be just what you’re after! Think of index funds as a group of investments that aim to copy the performance of a particular market index, like the S&P 500. This means they invest in the same companies listed in that index.

So, why do so many people like them? First, index funds make it easy to spread out your investments, which lowers your risk. Plus, they usually come with lower fees because they don’t need a team of managers constantly trading.

The article discusses several key points related to index fund investing for beginners:

- Introduction to Index Funds: Explains what index funds are and how they work.

- Benefits of Index Funds: Highlights the advantages, such as low costs and diversification.

- How to Start Investing: Provides a step-by-step guide on how to begin investing in index funds.

- Risk Consideration on Investing in Index Funds: Explain risks such as market risk, lack of flexibility, tracking errors, and long-term commitment.

- Common Misconceptions: Addresses and debunks common myths about index fund investing.

- Long-Term Strategy: Emphasizes the importance of a long-term approach to investing in index funds.

Introduction To Index Funds

Index funds are like a package of investments designed to match the performance of a specific market index, which is a group of stocks or bonds representing a part of the market. For example, the S&P 500 includes 500 large U.S. companies.

Here’s how they work: Instead of picking individual stocks, an index fund invests in the same ones as its target index. So, if the index goes up or down, the fund does too. There are different types, like:

- Stock Index Funds: Track stock market indices like the S&P 500.

- Bond Index Funds: Follow bond indices, providing steadier income.

- International Index Funds: Invest in markets outside your home country for more diversity.

In short, index funds give you an easy way to invest broadly without needing to manage it constantly.

Benefits of Index Funds Investing

Index funds come with several great benefits that make them popular among investors. Here’s why:

Diversification: When you invest in an index fund, your money is spread across lots of different stocks or bonds in the index. This helps reduce risk because if one company doesn’t do well, others might still perform well.

Cost Efficiency: Index funds usually have lower fees since they don’t need a team of managers making decisions. This means more of your money stays invested.

Simplicity: Investing in index funds is simple and accessible. Instead of worrying about selecting individual stocks or bonds, you can invest in a diversified portfolio that tracks a market index. As a result, this approach reduces risk and saves time. Overall, it’s a smart and straightforward way to potentially earn solid returns.

Consistent Performance: Over time, index funds often do well. They match the market’s performance, which can lead to steady gains. This makes them a solid choice for long-term growth.

In short, index funds offer diversification, lower costs, simplicity, and reliable performance, which makes them a great option for many investors.

How to Start Index Funds Investing

Starting with index funds investing is straightforward. Here’s a step-by-step guide to get you going:

Choose the Right Index Fund:

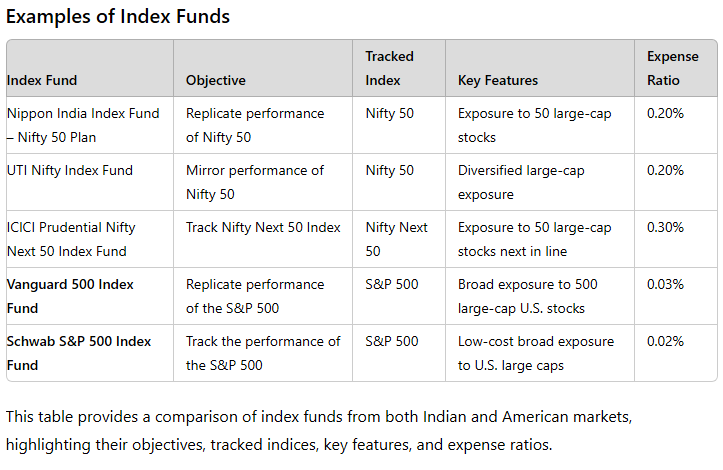

- Research Funds: Start by looking for index funds that track the market index you’re interested in. For example, if you want to invest in the U.S. stock market, you might pick a fund that tracks the S&P 500.

- Compare Costs: Check the expense ratio (the annual fee) of each fund. Lower fees are better because they reduce your overall costs.

Open an Investment Account:

- Select a Brokerage: Choose an online brokerage where you’ll open your account. Many offer easy setups with no minimum investment. For example, in the US Vanguard, Fidelity, and Robinhood are brokerages where you can invest index funds. Similarly in India, there is Zerodha, IndMoney etc.

- Complete the Application: Fill out the application with your details, financial info, and investment goals.

Fund Your Account:

- Deposit Money: Transfer funds into your account via bank transfer or by linking your bank account to the brokerage.

Buy Index Funds:

- Place an Order: After funding your account, buy shares of the index fund by entering its ticker symbol and the amount you want to invest.

- Set Up Automatic Investments: Consider setting up automatic investments. With this approach, a set amount is invested regularly, like every month. It helps you stay consistent with your investing. Plus, it can smooth out the ups and downs of the market.

Monitor Your Investment:

- Check Performance: Regularly check how your index fund is doing. While index funds don’t need frequent management, it’s good to stay informed.

- Adjust as Needed: If your goals change, you might need to adjust your investments. The same goes if your risk tolerance shifts. In that case, you could consider buying into different index funds. Adjusting your investments helps keep them aligned with your new goals.

In summary, start by picking the right index fund. Then, open an investment account. After that, fund your account with money. Next, buy shares of the index fund. Finally, keep an eye on your investments. By following these steps, you can confidently start investing in index funds!

Risks and Considerations in Index Fund Investing

While index funds have lots of perks, it’s also good to know about some possible risks:

- Market Risk: Index funds can fluctuate with the market. If the market goes down, so does the value of your fund.

- Lack of Flexibility: You can’t choose specific stocks; the fund invests in everything in its index.

- Tracking Error: Index funds might not perfectly match their target index due to fees or differences in holdings.

- Long-Term Commitment: Index funds are best for long-term investing, not quick gains.

In summary, understanding these risks helps align your investments with your goals.

Common Misconceptions of Index Funds Investing

There are a few common myths about index fund investing that might make some people unsure. Let’s clear them up:

1. Index Funds Are Only for Passive Investors:

- Myth: People think index funds are just for those who don’t want to actively manage their investments.

- Reality: While they’re great for passive investors, active investors also use them for diversification and balance.

2. Index Funds Guarantee High Returns:

- Myth: Some believe index funds will always give high returns.

- Reality: Index funds aim to match the market, not exceed it. They don’t guarantee high returns and can still lose value.

3. Index Funds Are Risk-Free:

- Myth: People often think index funds are completely risk-free.

- Reality: They carry market risk because they track an index, which means they can go up or down with the market.

4. All Index Funds Are the Same:

- Myth: There’s a belief that all index funds are identical.

- Reality: Different index funds track different indices and have varying fees, risks, and focuses. It’s important to choose one that fits your goals.

Understanding these myths helps you make smarter choices with index funds. While they offer many benefits, it’s important to know their limits. This knowledge will help you use them wisely in your investment strategy.

Conclusion

In summary, investing in index funds is a simple and effective way to grow your money. Firstly, these funds offer benefits like spreading out your investments (diversification), lower costs, and easy management.

Secondly, they’re designed to follow the performance of a specific market index, which gives you broad exposure to the market with very little effort. Overall, this makes index funds a good choice for building your savings over time.

Thirdly, investing in index funds is a simple and effective way to grow your money. These funds offer benefits like diversification, lower costs, and easy management. They’re designed to follow the performance of a specific market index, giving you broad market exposure without a lot of effort.

However, it’s important to remember that index funds have risks, such as market ups and downs and limited control over specific investments. By understanding these risks and common myths, you can make better decisions. If you want a simple strategy with long-term growth potential, index funds could be a good choice. Start by researching the right funds. Then, open an account and invest regularly. With this knowledge, you can confidently include index funds in your investment plan.