Introduction

Imagine having a plan for your money, knowing exactly what you’re saving for and why. Think about where you want to be financially in ten or twenty years. Long-term financial goals guide your decisions over many years, keeping you focused. Unlike short-term goals like saving for a vacation, long-term goals need careful planning and effort.

So, how do you get started? This essay will show you how to set and achieve long-term financial goals. We’ll cover creating a solid financial plan, tracking progress, and adjusting your plan as needed. By following these steps, you can secure a stable and prosperous financial future.

Here are the key points we’ll discuss:

- Identify Long-Term Financial Goals: Examples include retirement savings, home purchase, and education funding.

- Set SMART Goals: Ensure goals are Specific, Measurable, Achievable, Relevant, and Time-bound.

- Develop a Financial Plan: Create a budget, select investments, and establish an emergency fund.

- Putting Your Financial Plan into Action: Monitor progress, adjust goals as necessary, and consult financial advisors.

- Overcome Challenges: Manage market changes, balance short- and long-term goals, and stay disciplined and motivated.

I. Identify Long-Term Financial Goals

Long-term financial goals are big objectives that take years, or even decades, to achieve. They need careful planning and steady effort. Unlike short-term goals, which you can reach in a few months, long-term goals involve major milestones. For example, saving for retirement, buying a house, or paying for your kids’ education. They require you to think ahead and make smart financial choices over time.

Long-term goals give you direction and purpose. They help you focus your financial efforts on achieving significant milestones. By setting these goals, you create a roadmap for your financial future. This roadmap then guides your decisions on managing and investing money effectively.

For example, if your goal is to retire comfortably, you might invest in retirement accounts like 401(k)s or IRAs. On the other hand, if you aim to buy a home, you might save regularly and invest in real estate. Each goal shapes your overall financial strategy. This means you need specific strategies and actions, which influence how you manage your finances

II. Set SMART Goal To Achieve Long-Term Financial Goals

SMART goals are a great way to set clear and attainable objectives. SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound. Let’s break down what each of these means.

Specific goals are clear and detailed. Instead of just saying, “I want to save money,” you could say, “I want to save $20,000 for a down payment on a house.” This way, you know exactly what you need to do.

Next, Measurable goals allow you to track your progress. For example, if your goal is to save $20,000, you can measure how much you’ve saved each month. This helps you see if you’re on track and make changes if needed.

Then, we have Achievable goals. These should be realistic and within your reach. For instance, if you’re saving $200 a month, aiming to save $20,000 in a year might be too much. Instead, set a target that fits your financial situation.

Relevant goals should align with your overall plans. If you want to buy a house, saving for a down payment is a relevant goal. Make sure your goals support your long-term objectives.

Finally, Time-bound goals have a clear deadline. For example, aiming to save $20,000 in two years gives you a specific timeframe to work towards. Deadlines help you stay focused and motivated.

So, remember to make your goals SMART: Specific, Measurable, Achievable, Relevant, and Time-bound to keep on track and reach your dreams!

III. Developing a Financial Plan

Developing a financial plan is a key step in reaching your long-term financial goals. This step involves creating a detailed roadmap for how you will manage your money. Let’s break it down into simpler steps:

Creating a Budget

First, you need to create a budget. A budget helps you track your income and expenses, making sure you spend less than you earn. Start by listing all the money you get, like your allowance, part-time job earnings, or gifts. Then, write down all your expenses, like buying snacks, and clothes, or going out with friends. One effective way is zero-based budgeting, where you give every dollar a specific job. This way, you know exactly where your money is going, and you can save more effectively.

Selecting Investments

Next, let’s talk about investing. Investing is important because it helps your money grow over time. Depending on your goals, you’ll need to pick the right investments that match how much risk you’re willing to take and how long you plan to invest.

For example, if you’re saving for something far in the future like retirement, you might choose a mix of stocks, bonds, and mutual funds. If you’re planning to buy something sooner, like a car in a few years, you might want safer investments.

Diversifying your investments means spreading your money across different types of investments such as equities, mutual funds, bonds, gold, and real estate. This helps reduce risk. Specifically, it’s a good idea to research your options. You can also talk to a financial advisor for advice.

Establishing an Emergency Fund

Finally, let’s not forget about an emergency fund. This is super important because it acts like a safety net for unexpected expenses, such as medical bills, car repairs, or losing a job. Experts say you should save enough to cover three to six months’ worth of living expenses. This way, you won’t have to go into debt when something unexpected happens. To build your emergency fund, start by saving a little bit each month until you reach your goal.

By developing a financial plan that includes creating a budget, selecting the right investments, and establishing an emergency fund, you’ll be well on your way to achieving your long-term financial goals. Additionally, this plan will guide you, helping you make smart decisions and stay focused on what’s important: securing your financial future. So, why wait? Start planning today!

IV. Putting Your Financial Plan into Action

Putting your financial plan into action means doing what you’ve planned. This step involves following your budget, making investments, and managing your savings according to the plan you’ve created. By sticking to your plan, you’ll get closer to achieving your financial goals.

Tracking Your Progress

Why Tracking Is Important

First, let’s talk about why tracking is important. Tracking your progress helps you see how well you are following your financial plan. It shows whether you are meeting your savings and investment targets. Regularly reviewing your progress helps you stay motivated and make adjustments if needed.

How to Track Your Progress

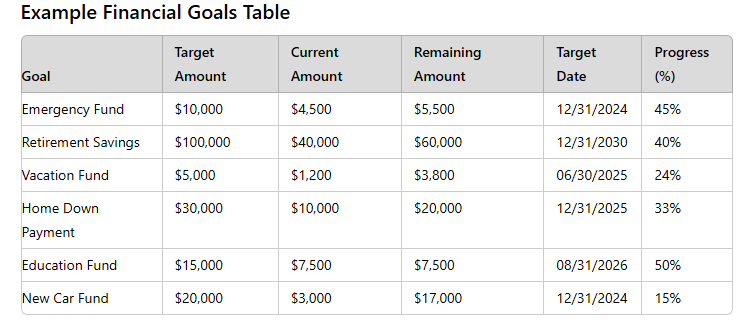

Next, let’s look at how to track your progress. You can use financial apps, spreadsheets, or simple reports. For example, if you’re saving for a vacation, you might check your savings account balance each month to see if you’re on track to reach your goal.

Setting Up Regular Check-Ins

Now, let’s set up regular check-ins. Schedule regular check-ins, like monthly or quarterly, to review your financial situation. During these check-ins, compare your actual progress with your plan. This routine helps you stay aware of your financial health and make timely adjustments.

Adjusting Goals and Plans

When to Adjust Your Plan

Sometimes, you’ll need to adjust your plan. Life changes, like a new job, unexpected expenses, or changes in your financial situation, might require you to tweak your plan. For instance, if you receive a raise, you might increase your savings rate. On the other hand, if you face a major expense, you might need to reduce your savings temporarily.

How to Make Adjustments

Here’s how to make adjustments. Start by reassessing your goals and financial situation. Determine if you need to change your budget, investments, or savings strategies. For example, if your initial goal was to save $20,000 in two years but you need more time, you might extend the deadline or adjust the monthly savings amount.

Staying Flexible

Staying flexible is key. Financial plans are not set in stone and should evolve as your life and goals change. Regularly reviewing and updating your plan ensures it remains relevant and effective.

Seeking Professional Advice

When to Consult a Financial Advisor

Now, when should you consult a financial advisor? If you need expert guidance, consulting a financial advisor can be helpful. An advisor can assist with complex financial issues, like investment strategies, tax planning, or retirement planning. Seek advice if you feel uncertain about making changes to your plan.

Choosing the Right Advisor

So, how do you choose the right advisor? Look for someone with experience and credentials relevant to your needs. Check their qualifications, client reviews, and areas of expertise to ensure they align with your financial goals.

Benefits of Professional Guidance

Here are the benefits of professional guidance. A financial advisor can provide personalized advice, help you make informed decisions, and offer strategies to achieve your goals efficiently. Their expertise can add value and help you navigate financial challenges more effectively.

Why Implementation and Adjustment Are Crucial

Finally, let’s talk about why implementation and adjustment are crucial. Putting your plan into action and making adjustments when needed is essential for staying on track toward your goals. Regularly tracking progress and making necessary adjustments help you adapt to changes and remain focused on achieving your financial objectives. With a flexible and well-executed plan, you can effectively manage your finances and work towards long-term success. So, start today and keep adjusting as you go!

V. Overcoming Common Challenges

Dealing with Market Fluctuations

Understanding Market Fluctuations

Let’s start by talking about what market fluctuations are. Basically, they’re changes in the value of your investments because of things like the economy, political events, or trends in the market. These ups and downs can cause your investments to suddenly gain or lose value. But here’s the thing: these changes are totally normal and just a part of investing.

Strategies for Managing Fluctuations

So, how can you deal with these fluctuations? One good strategy is something called diversification. This means spreading out your investments across different things like stocks, bonds, and real estate. By doing this, if one investment isn’t doing well, another one might still be doing okay. Another smart move is to think long-term. When you focus on the bigger picture, you’re less likely to make quick decisions based on short-term changes in the market. Stick to your plan and keep your eyes on your long-term goals instead of getting caught up in the day-to-day ups and downs.

Rebalancing Your Portfolio

Another way to manage risk is by rebalancing your investment portfolio every now and then. This just means adjusting your investments to make sure they still match your goals and how much risk you’re comfortable with. For example, if your stocks have done really well and now take up a bigger chunk of your portfolio, you might sell some and invest in something safer like bonds to get back to your original plan.

Balancing Short-Term and Long-Term Goals

Identifying Your Goals

Now, let’s talk about balancing your short-term and long-term goals. It’s important to know that you probably have both types of goals. Short-term goals could be things like saving for a vacation or a new bike, while long-term goals might be planning for college or even saving for a house someday. To balance these goals, you need to plan carefully and figure out what’s most important.

Allocating Resources

Here’s how you can balance those goals: split your money between short-term and long-term needs. Maybe you decide to save 20% of your allowance or part-time job earnings for short-term stuff, like that new bike and put 30% into a savings account for long-term goals, like college.

Adjusting as Needed

It’s also a good idea to regularly check on how you’re doing with both your short-term and long-term goals. If something changes, like getting extra money from a birthday or facing an unexpected expense, adjust how you’re saving and spending. Being flexible helps you stay on track with all your goals.

Maintaining Discipline and Motivation

Setting Realistic Goals

To stay disciplined and motivated, it’s important to set goals that are realistic and within reach. Make sure your goals are specific and measurable. For example, instead of trying to save $1,000 in a month, set a smaller, more achievable goal and break it into steps.

Tracking Progress and Celebrating Successes

Tracking your progress is a great way to stay motivated. Celebrate your successes, even the small ones, to keep yourself encouraged. For instance, if you hit a savings goal, treat yourself to something small or just take a moment to feel proud of what you’ve achieved.

Staying Focused on the Big Picture

Finally, keep the big picture in mind. Remind yourself why you set these goals in the first place and what you’ll gain by reaching them. Thinking about the result can give you the motivation you need to stay disciplined and keep working toward your goals.

Why Overcoming Challenges Is Important

Overcoming challenges is super important if you want to reach your financial goals. By handling market fluctuations, balancing different goals, and staying disciplined, you can stay on track and keep moving forward. Tackling these challenges head-on helps you stay focused and motivated, which is key to achieving long-term financial success.

VI. Conclusion

Recap of Key Points

In this essay, we talked about how to set and achieve long-term financial goals. We started by learning what long-term goals are and why they matter. Then, we discussed how to set effective goals using the SMART framework, which helps you make your goals Specific, Measurable, Achievable, Relevant, and Time-bound. After that, we explored how to create a detailed financial plan and how to put that plan into action, making adjustments as needed. Finally, we looked at some common challenges, like dealing with market ups and downs, balancing different goals, and staying motivated along the way.

Final Thoughts

Reaching your long-term financial goals takes careful planning, discipline, and the ability to make changes when necessary. By setting clear, achievable goals and creating a solid financial plan, you’re setting yourself up for success. It’s important to stay flexible, though, because life can throw unexpected changes your way, and your financial plan should be able to adapt.

Call to Action

Now it’s time to take action! Start by setting your own long-term financial goals today. Create a budget, begin saving, and make smart investments. Don’t forget to check in on your progress regularly and adjust your plan as needed. With commitment and perseverance, you can achieve your financial goals and enjoy the peace of mind that comes with knowing your future is secure. So, why wait? Start planning your financial future today!