Equity Mutual Funds are investment tools that pool money from many investors to buy shares. These funds aim to grow your money over time by investing in stocks. Here’s an easy-to-read guide on equity mutual funds:

What Are Equity Mutual Funds?

Equity mutual funds primarily invest in stocks. They offer the potential for higher returns than other types of mutual funds. These funds are managed by professionals who decide which stocks to buy, keep, or sell to maximize returns for investors.

Types of Equity Mutual Funds

Equity mutual funds come in different types, each with its own strategy and risk level:

Large-Cap Equity Mutual Funds

Large-cap funds invest in well-known, established companies. Therefore, these funds generally have lower risk than small and mid-cap funds. They are ideal for conservative investors looking for stable returns. Large-cap funds offer a safer investment option for those who want to preserve their capital and achieve steady growth.

Mid-Cap Funds Equity Mutual Funds

Mid-cap funds focus on medium-sized companies that have significant growth potential. Although these funds can be more volatile than large-cap funds, they may offer higher returns. Generally, they are ideal for investors with a moderate risk tolerance who are comfortable with some market fluctuations in exchange for the chance of higher gains. Additionally, mid-cap companies are often in a key growth stage, which can present opportunities for substantial profits.

Small-Cap Equity Mutual Funds:

Small-cap funds invest in smaller companies that have high growth potential. While these funds can be highly volatile and riskier than large-cap and mid-cap funds, they are suited for aggressive investors who aim for higher returns. Although small-cap companies offer significant growth opportunities, they have greater market risks. Therefore, investors should have a higher risk tolerance to handle the potential ups and downs.

Multi-Cap Funds

Multi-cap funds invest in a diverse mix of large, mid, and small-cap stocks. This approach offers a balanced risk and reward profile. These funds are ideal for investors looking for a diversified portfolio that captures the growth potential of small and mid-cap companies while benefiting from the stability of large-cap stocks. By spreading investments across various market segments, multi-cap funds help manage risk and opportunities in different areas.

Sectoral/Thematic Funds

Sectoral or thematic funds focus on specific sectors, like technology, or themes, such as infrastructure. These funds are higher risk because they concentrate on one area. They are suitable for investors who are confident in particular sectors. While targeting specific industries or themes can lead to significant gains if the chosen sector performs well, it also carries the risk of underperformance.

Equity-Linked Savings Scheme (ELSS)

Equity-Linked Savings Scheme (ELSS) funds provide tax benefits under Section 80C of the Income Tax Act in India. These funds come with a lock-in period of three years. They offer the chance for both growth and tax savings. So, ELSS funds are ideal for investors who want to blend wealth creation with tax efficiency. The required lock-in period encourages long-term investing, which can lead to substantial returns over time while also providing tax deductions.

| Type of Equity Mutual Funds | Invested In | Potential Growth | Risk Level | Ideal Investors |

| Large Cap Mutual Fund | Large Cap Companies | Moderate | Low | Investors seeking diversification and balanced growth |

| Conservative Investors seeking a stable return | Mid Cap Companies | Higher | Moderate | Moderate risk tolerance looking for growth |

| Small Cap Mutual Fund | Small Cap Companies | Very High | High | Aggressive investor aiming for significant growth |

| Multi-Cap Mutual Fund | Large, Mid and Small Cap Companies | Balanced | Moderate | High to Very High |

| Sectoral/Thematic Mutual Fund | Specific Sector or Theme | High to Very high | Mid-Cap Mutual Fund | Investors confident in specific sectors or themes |

| Equity Linked Saving Scheme (ELSS) | Equity shares with tax benefits under Section 80C | High to Very High | Moderate to High | Investors looking for tax benefits and growth |

Benefits of Investing in Equity Mutual Funds

Professional Management

Equity mutual funds are managed by experts who make informed investment decisions. The professional management team selects stocks strategically, handles portfolio management, assesses risks, and applies various investment strategies like growth, value, and income. Their expertise aims to maximize returns and effectively manage risk.

Diversification

Equity mutual funds offer diversification by spreading investments across different stocks, sectors, and geographic regions. Consequently, they reduce risk and improve returns by minimizing the impact of poor performance in individual stock investments.

Liquidity

These funds offer high liquidity. It means investors can easily buy and sell shares through these funds. Investors can typically redeem their shares at the current net asset value (NAV) on any business day, providing quick access to their money.

Potential for High Returns

Equity mutual funds have the potential for higher returns compared to debt funds and fixed-income investments over time. By investing in stocks with strong growth potential, these funds benefit from market upswings, capital appreciation, and reinvested dividends, offering the possibility of significant long-term gains.

Tax Efficiency

Equity mutual funds generally provide greater tax efficiency for long-term capital gains than debt mutual funds. In many regions, long-term gains from equity funds are taxed at a lower rate or may qualify for certain exemptions. In contrast, gains from debt funds are often taxed at a higher rate and may not enjoy the same favorable tax treatment.

Risks of Equity Mutual Funds

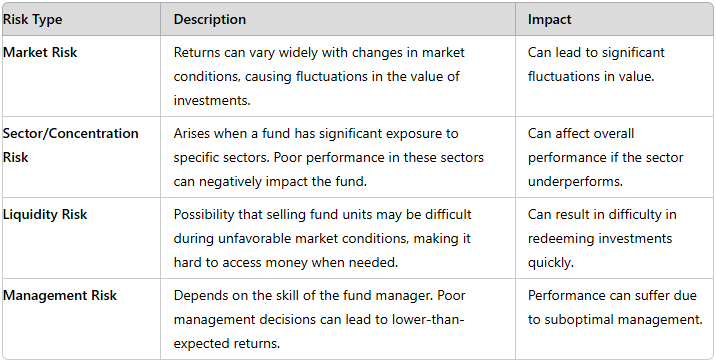

Market Risk

Equity mutual funds carry market risk, which means their returns can vary widely with changes in market conditions. This inherent volatility can cause fluctuations in the value of your investments.

Sector/Concentration Risk

Sector or concentration risk arises when a fund has significant exposure to specific sectors. If these sectors do not perform well, it can negatively impact the fund’s overall performance.

Liquidity Risk

Liquidity risk refers to the possibility that selling fund units may be difficult during unfavorable market conditions. This can make it harder for investors to access their money when needed.

Management Risk

Management risk is another important factor. The success of equity mutual funds depends on the fund manager’s skill. Poor management decisions can result in lower-than-expected returns.

How to Choose the Right Equity Mutual Funds

Investment Goals

First, align your fund choice with investment goals, risk tolerance, and time frame. You should choose an equity mutual fund if your goal is long-term capital gain because equity mutual funds aim for long-term capital appreciation.

Fund Performance

Secondly, examine past performance for consistency. Compare a fund’s returns to its benchmarks over different periods. Look at how consistently it performs, how it handles risk, its expense ratio, and the manager’s experience. Remember, past performance doesn’t guarantee future results.

Expense Ratio

Thirdly, check the fund’s expense ratio, which shows the annual cost of managing the fund as a percentage of its assets. Lower expense ratios are generally better. According to SEBI guidelines, equity fund expense ratios can be up to 2.25%, while debt funds have a cap of 0.75%. These guidelines were placed on April 1, 2019, to ensure transparency and standardization in mutual fund costs.

Fund Manager’s Track Record

Fourthly, evaluate the fund manager’s history. Look at their past performance, ability to meet investment goals, adherence to their strategy, and reputation. A skilled manager is crucial for achieving good returns.

Diversification

Finally, ensure that the fund has a well-diversified portfolio. It should invest across various sectors, industries, company sizes, and geographic regions. Diversification helps spread risk and can lead to better long-term returns.

How to Invest in Equity Mutual Funds

Directly Through the AMC:

You can invest directly with the Asset Management Company (AMC) to save on costs. Choose funds that match your goals and risk tolerance. AMCs manage diversified portfolios aiming for long-term growth.

Through a Broker or Advisor

Consider investing through a broker or advisor, although this might involve additional costs. Brokers offer access to a wide range of funds and provide expert guidance, helping you select and manage your investments effectively.

Online Platforms

Invest conveniently through online platforms like Zerodha Coin, Groww, or ET Money. These platforms provide easy access to different funds and tools to manage, track, and transact your investments.

Systematic Investment Plans (SIPs)

A Systematic Investment Plan (SIP) allows you to invest regularly and systematically. SIPs offer benefits like rupee cost averaging and compounding. While they are subject to market fluctuations, they are ideal for long-term investors looking to spread investment risks over time.

Lump Sum Investment

If you have a substantial amount ready, consider a lump sum investment. This involves investing a large sum at once, which can provide immediate market exposure. However, it lacks the cost-averaging benefits of SIPs, so timing the market is crucial. Therefore, evaluate your risk tolerance and market conditions before proceeding.

Conclusion

Equity mutual funds are an excellent way to grow wealth through stock market investments. They come with risks, but by understanding different types and matching them with your goals, you can make informed choices for long-term growth.