Introduction

Did you know you can invest in real estate without having to buy a house or building? With REITs, you can get involved in the real estate market and start making money, all without the hassle of owning any property.

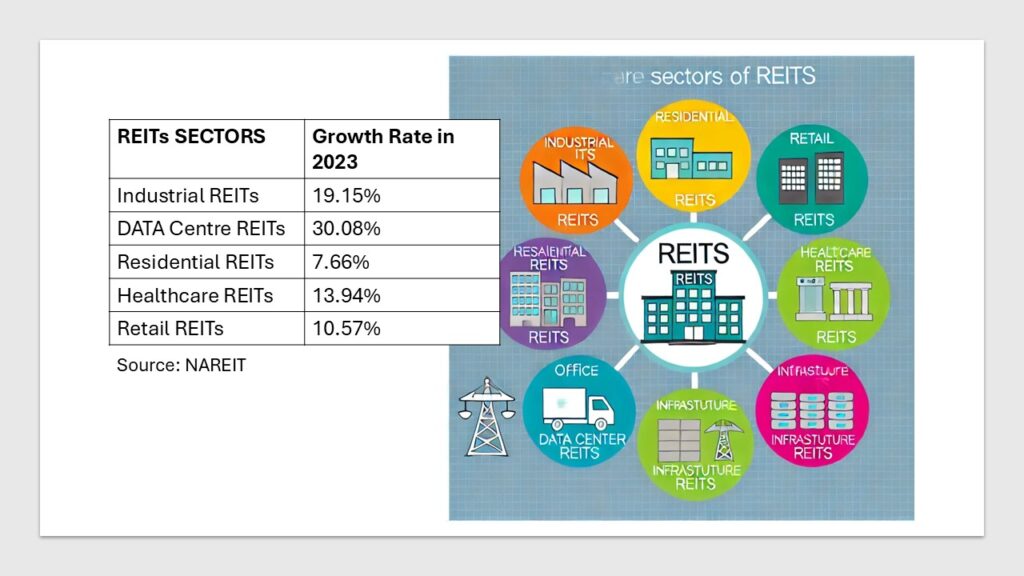

As we move into 2024, more people are talking about real estate investment trusts or REITs. They’re becoming a popular choice. REITs help you spread out your investments and earn a steady income. However, there are many different types. It can be tough to know where to put your money. For example, healthcare and industrial REITs are on the rise. There’s a growing need for medical buildings and e-commerce warehouses.

Meanwhile, residential and data center REITs are also becoming more popular as people need more housing, and companies need better data storage. By picking the right REIT sectors, you could boost your returns and lower your risks in today’s changing market.

1. Industrial REITs

Industrial REITs have been growing steadily for years, mainly because more and more people are shopping online. As online shopping gets more popular, the need for logistics and warehousing spaces has skyrocketed. Industrial REITs have seen steady growth, with some reports showing they’ve been increasing by about 5-7% each year. In 2023, the total growth in this sector was 19.15%. This trend is expected to keep going strong, and some experts think growth could be even higher in 2024 as online shopping continues to expand.

As companies focus more on faster deliveries, the demand for good industrial spaces might push growth even higher, maybe even into double digits in some areas. This makes the industrial sector a smart pick for investors who want to see their money grow over time.

Looking ahead to 2024, this trend is only getting stronger. Companies are pouring money into their supply chains and really need well-located distribution centers. This makes industrial REITs a dependable choice. Even when the economy isn’t doing great, people still need essential goods, so the demand for the infrastructure that delivers these goods stays strong.

Plus, with online shopping on the rise, businesses need to deliver products quickly, which pushes the demand for industrial spaces even higher. Many companies are now searching for warehouses closer to big cities to speed up shipping times. This demand for urban locations makes industrial REITs even more valuable, especially those near major transportation routes.

On top of that, as global trade keeps growing, there’s a bigger need for larger and more advanced logistics facilities. All these factors make industrial REITs a smart investment choice that could stay strong for a long time.

Performance of Industrial REITs

There are 11 Industrial REITs being tracked in this data. These REITs have an average dividend yield of 3.13%, which means if you invest in them, you could expect to earn about 3.13% of your investment back in dividends over a year.

However, the Year-to-Date (YTD) total return for these Industrial REITs is -1.75%. This means that so far in 2024, these REITs have actually lost a bit of value when you consider both the change in price and the dividends.

On the other hand, July was a much better month for these REITs, with a total return of 12.70%. This suggests that they recovered quite a bit in July.

Looking back at 2023, these Industrial REITs had a total return of 19.15%, showing that they performed really well last year.

In short, while Industrial REITs have had a tough start in 2024, they showed strong performance in July and had a great year in 2023. They still offer steady income through dividends, but their overall performance this year has been a bit rocky.

2. Data Center REITs

With all the changes in technology, the need for data storage and cloud computing is growing really fast. Data Center REITs own the buildings that store servers and other hardware for cloud services. These REITs have been growing a lot, with some reports showing they’ve been going up by 8-10% each year. This trend is likely to keep going strong in 2024, especially as more businesses and services move online, increasing the demand for data centers.

Cool new technologies like artificial intelligence and 5G are becoming more common too, which makes the need for strong data storage even bigger. That’s why Data Center Real Estate Investment Trusts are a key sector to keep an eye on this year. Companies are also making their online presence bigger and spending a lot of money on secure data systems. With more people working from home and using digital tools, the demand for these data centers has shot up even more.

These places aren’t just about storing data; they’re like the backbone of our digital world. They make sure data is easy to access, safe, and processed quickly. Because of this, Data Center REITs are likely to stay in high demand, making them a smart choice for investors who want to see their money grow over time. As technology keeps evolving, these Real Estate Investment Trusts will play a key role in keeping our global digital system running smoothly.

Performance of Data Centre REITs

There are only 2 Data Center REITs being tracked here. These REITs have an average dividend yield of 2.59%. This means if you invest in them, you could expect to earn about 2.59% of your investment back in dividends over a year.

So far in 2024, these Data Center REITs have given a total return of 3.98%. This includes both the money you could make from selling the investment and the dividends you earn. In July alone, the total return was 1.96%, which shows that July was a decent month for these REITs.

Looking back at 2023, these Data Center REITs had a fantastic total return of 30.08%. This means they performed extremely well last year, giving a huge boost to investors.

In short, Data Center REITs had a great year in 2023, but in 2024, they’re growing at a slower pace. Even so, they still offer steady income through dividends and have shown they can perform really well over time.

3. Residential REITs

Residential Real Estate Investment Trusts, especially those focused on apartment buildings, are still a smart investment as we move into 2024. Cities are getting bigger, and more people are moving to urban areas, which keeps the demand for rental housing strong. With mortgage rates staying high, more people are choosing to rent instead of buying a home. This makes Residential REITs even more appealing. They provide steady income, and they can adjust rents based on what’s happening in the market. This flexibility makes them a reliable choice for investors who want regular income.

As more people move to cities, they want to live close to work, schools, and other important spots. This is making apartments in popular city areas even more in demand. Residential Real Estate Investment Trusts are in a great position to take advantage of this trend because they offer different types of housing to fit various budgets and needs. In fact, some reports have shown that Residential REITs have seen growth rates of around 4-6% in recent years, and this could continue in 2024.

Another big plus is that these REITs can easily adjust rents when the housing market changes. This ability to adapt helps them stay strong even when things shift in the market. With all these benefits, Residential REITs are likely to keep providing strong and steady returns for investors in 2024 and beyond. So, if you’re looking for a smart investment, Residential REITs are worth considering.

Performance of Residential REITs

18 Residential REITs are being tracked in NAREIT. These REITs have an average dividend yield of 3.47%, which means if you invest in them, you could expect to earn about 3.47% of your investment back in dividends over a year.

So far in 2024, these Residential REITs have given a total return of 8.75%. This number includes both the money you could make from selling the investment and the dividends you earn. However, in July alone, the total return was just 0.75%, which suggests that July wasn’t a particularly strong month for these REITs.

Looking back at 2023, these Residential REITs had a total return of 7.66%. This shows that they’ve been performing steadily, but their returns this year seem to be a bit better than last year.

In short, Residential REITs are offering a decent return, especially for 2024 so far, with a steady income through dividends and some growth potential. However, they had a quieter month in July compared to the rest of the year.

4. Healthcare REITs

The healthcare sector is expected to do really well in 2024, mainly because more people are getting older and need more healthcare services. Healthcare REITs, which invest in places like hospitals, nursing homes, and senior living communities, are becoming more popular with investors. They offer both stability and growth potential, making them a smart choice. Since there’s always a need for healthcare, these REITs are appealing to investors. Plus, the properties they invest in usually have long-term leases, which means steady income.

As the population keeps aging, the demand for medical services and senior care facilities will keep growing. This steady demand means healthcare properties will likely stay full, ensuring reliable cash flow for Healthcare REITs.

Another big plus is that many of these healthcare properties have long-term leases. This gives investors predictable income, which is always a good thing. What’s even better is that this sector is less affected by economic downturns since people always need healthcare, no matter what’s happening with the economy. Because of all these reasons, Healthcare REITs are in a good position to give investors stable returns while also offering the chance for growth as the healthcare industry continues to expand.

Healthcare REITs Performance

16 Healthcare REITs are being tracked by NAREIT. These REITs have an average dividend yield of 3.98%. This means if you invest in them, you could expect to earn around 3.98% of your investment back in dividends over the course of a year.

So far in 2024, these Healthcare REITs have provided a total return of 17.35%, which is quite impressive. This number includes both the money you could make from selling the investment and the dividends you earn. They also had a pretty good performance in July alone, with a total return of 6.42% for that month.

Looking back at last year, in 2023, these Healthcare REITs had a total return of 13.94%. This shows that they’ve been doing well consistently, not just this year but also in the previous year.

In short, Healthcare REITs seem to be a solid investment, offering a good mix of steady income through dividends and the potential for growth in value.

5. Retail REITs

The retail sector has been through some tough times lately, mainly because of the growth of e-commerce. However, certain types of Retail REITs are expected to bounce back and do well in 2024. In particular, REITs that focus on high-quality, well-located retail properties, like grocery-anchored shopping centers and places that offer unique shopping experiences, are likely to keep thriving. These properties offer essential services and experiences that you just can’t get online. That’s why they’re stronger and more resilient as shopping habits keep changing.

For example, grocery-anchored shopping centers continue to see a steady flow of customers. People need to buy groceries regularly, no matter how the economy is doing. In fact, some studies have shown that grocery-anchored centers have seen a growth rate of around 2-3% annually over the past few years. These centers often turn into community hubs, which helps bring more customers to other stores and services nearby.

On the other hand, experiential retail destinations, like entertainment venues or specialty stores, have their own special appeal. They offer one-of-a-kind experiences that draw people in, creating a loyal customer base that also supports the surrounding shops. Because of all these factors, these types of Retail REITs are likely to stay strong in 2024, even as online shopping continues to grow.

Retail REITs Performance

28 retail REITs are being tracked in NAREIT, and they have an average dividend yield of 4.78%. This means if you invested in them, you could expect to earn about 4.78% of your investment back in dividends over a year.

So far in 2024, these REITs have given a total return of 7.63%, which includes both the money you could make from selling the investment and the dividends you earn. They did especially well in July, with a 7.4% return just for that month. Last year, in 2023, they performed even better, giving a total return of 10.57%. Overall, these Retail REITs seem to be doing pretty well, offering both steady income and potential for growth.

Conclusion

Investing in REITs gives you a way to get into the real estate market without dealing with the hassle of owning actual property. As you think about your investment plan for 2024, it’s a good idea to focus on high-potential sectors like Industrial, Data Centers, Residential, Healthcare, and even some Retail. These sectors could help you find the growth and stability you need in the year ahead. By staying informed and carefully picking which REIT sectors to invest in, you can set yourself up for success in the constantly changing real estate world.

Each of these sectors has its own strengths. This means you can spread your investments across different areas of real estate, which helps reduce risk. At the same time, you get a chance to benefit from the growth in each sector. With the right strategy, REITs can give you both steady income and long-term growth, making them a smart addition to your investment portfolio.

Are you ready to start building a strong investment portfolio? Think about adding REITs to your plan for 2024. Check out the different sectors, keep yourself informed, and make smart choices that fit your goals. Start investing in REITs today and take the first step toward earning a steady income and growing your money over time!