- Introduction

- Understanding Dollar-Cost Averaging: A Key Investment Strategy

- Benefits of Dollar-Cost Averaging for Long-Term Investors

- How to Implement Dollar-Cost Averaging in Your Investment Portfolio

- Comparing Dollar-Cost Averaging with Other Investment Strategies

- Ideal Conditions for Dollar-Cost Averaging

- Potential Drawbacks and Considerations

- Practical Tips for Successful Implementation of Dollar-Cost Averaging

- Historical Case Studies Illustrating DCA Success

- Real-Life Examples of Successful Dollar-Cost Averaging

- Summary of Key Points

Introduction

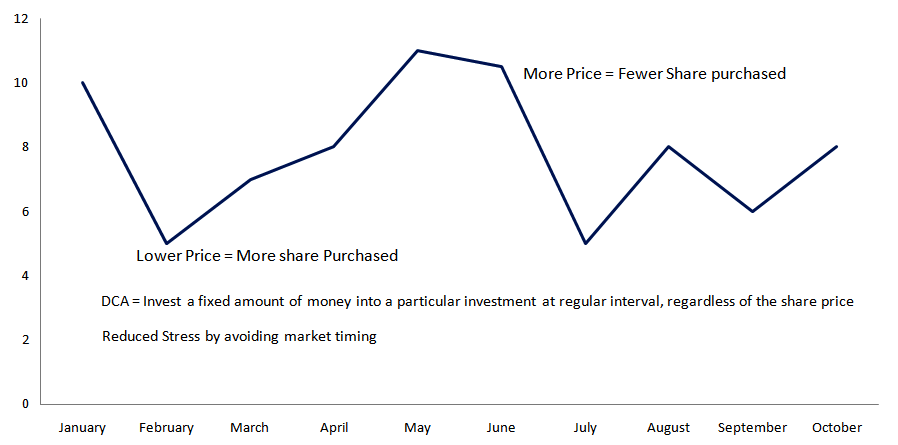

Hey there! Have you ever wondered how you can invest without worrying too much about the ups and downs of the market? Well, that’s where Dollar-Cost Averaging (DCA) comes in! It’s an easy and popular way to invest by putting in a fixed amount of money at regular times, no matter what the price of the asset is. This way, you buy more shares when prices are low and fewer when they’re high.

So, why is this cool? The main benefit is that it helps you avoid making bad investment choices based on sudden market changes. Instead of stressing about timing the market perfectly, you stick to a steady plan. This approach is super helpful, especially if you’re new to investing or like a consistent routine.

In this chat, we’ll dive into DCA—how it works, its perks, and some things to watch out for. By the end, you’ll know if this strategy fits your investment goals. Sounds good? Let’s get started!

Understanding Dollar-Cost Averaging: A Key Investment Strategy

Dollar-cost averaging (DCA) is a smart way to invest. Instead of trying to guess the best time to buy and sell, you just invest a fixed amount of money regularly, like every month. No matter if the price is high or low, you keep investing the same amount. This way, you end up buying more shares when prices are low and fewer shares when prices are high. It’s a steady and less stressful approach to investing, making it easier for anyone to get started and stay on track.

Historical Background

Dollar-Cost Averaging has been a go-to strategy for investors for many years. It became popular because it helps manage investment risks and avoids the trouble of trying to time the market perfectly. The main idea behind DCA is that it’s really tough to predict how the market will move. By investing a fixed amount regularly, you can lessen the impact of the market’s ups and downs on your investment. This way, you don’t have to worry as much about when to buy or sell.

How DCA Works

Okay, so let’s talk about how Dollar-Cost Averaging (DCA) works in real life. Imagine you set up automatic investments every month or quarter. For example, you decide to invest $200 every month in a mutual fund. No matter what the fund’s price is, you keep investing that $200. When the market is down, your $200 buys more shares. When the market is up, it buys fewer shares. Over time, this helps to balance out the cost of the shares, making your investment less risky.

Benefits of Dollar-Cost Averaging for Long-Term Investors

Reduction of Market Timing Risk

Dollar-Cost Averaging (DCA) makes investing easier and less risky. Trying to time the market means buying when prices are low and selling when they’re high, but that’s really hard to do accurately. Instead, with DCA, you invest a fixed amount regularly, no matter what the market is doing. This way, you don’t have to stress about perfect timing. It’s a simple and steady approach that helps you avoid the challenges and worries of predicting market movements.

Easing of Investment Decisions

Another great thing about Dollar-Cost Averaging (DCA) is that it makes investing easy. Instead of stressing about the best time to invest, you just follow a regular schedule. This routine removes the pressure of reacting to daily market changes. By setting up automatic investments, you can focus on your long-term goals without worrying about short-term ups and downs. This method is especially helpful for new investors or anyone who prefers a simple, hands-off approach.

Lower Average Cost per Share Over Time

Dollar-Cost Averaging (DCA) helps you get a lower average cost per share over time. By investing a fixed amount regularly, you buy more shares when prices are low and fewer shares when prices are high. This way, your average cost per share smooths out, especially in markets where prices go up and down a lot. This strategy spreads your investment over time, so you don’t risk putting all your money in at a bad time.

Psychological Benefits and Stress Reduction

Investing can be pretty stressful, especially when the market goes down. Dollar-cost averaging (DCA) helps reduce this stress by taking away the pressure of trying to time the market perfectly. With DCA, you know you’re investing regularly, no matter what the market is doing, which can give you peace of mind. This steady approach keeps you disciplined and helps prevent emotional decisions influenced by market ups and downs. As a result, you might feel less anxious and more confident about reaching your long-term financial goals.

How to Implement Dollar-Cost Averaging in Your Investment Portfolio

Investment Regularity

Dollar Cost Averaging (DCA) is a way of investing where you put in a fixed amount of money regularly, like every month or every three months. Imagine you decide to invest $100 each month in a mutual fund. No matter if the market is doing well or not, you still invest that same $100 every month.

This method helps you develop a good habit of saving and investing. Plus, it makes it easier to stick to your financial goals because you don’t have to worry about when is the best time to invest. By consistently putting money into your investments, you can stay on track and feel more confident about your future.

Impact on Investment Portfolio

The impact of Dollar Cost Averaging (DCA) on your investments can be really important. When you invest regularly, you end up buying more shares when prices are low and fewer shares when prices are high. This way, you don’t have to worry about trying to guess the best time to invest.

By spreading out your investments, you can smooth out the ups and downs of the market. Over time, this helps to lower the average cost per share, because you’re not putting all your money in at once. Plus, it reduces the risk of making bad investment choices based on market timing. This way, you can feel more confident that you’re making smart decisions with your money.

Let’s look at an example to see how Dollar Cost Averaging (DCA) works.

Imagine you decide to invest $200 every month into a stock, and the stock price changes each month. In the first month, the stock price is $10 per share. So, with your $200, you buy 20 shares ($200 / $10 per share).

Next, in the second month, the stock price drops to $5 per share. Now, with your $200, you can buy 40 shares ($200 / $5 per share).

Then, in the third month, the stock price goes up to $8 per share. With your $200, you buy 25 shares ($200 / $8 per share).

After three months, you’ve invested a total of $600 and bought 85 shares (20 shares + 40 shares + 25 shares). To find out your average cost per share, you divide the total amount you invested by the total number of shares you bought. Even though the stock price went up and down, your average cost per share is lower than the average price of the stock over those three months. This example clearly shows how DCA helps you handle price changes and get a better average purchase price.

| Month | Stock Price per share | Amount Invested | Share Purchase | Total Share Purchase | Average price Per Share |

| 1 | $10 | $ 200 | 20 | 20 | $ 10 |

| 2 | $ 5 | $ 200 | 40 | 60 | $ 6.67 |

| 3 | $ 8 | $ 200 | 25 | 85 | $ 7.06 |

Explanation:

- Month 1: You invest $200 when the stock price is $10 per share, buying 20 shares.

- Month 2: The stock price drops to $5 per share. With the same $200 investment, you buy 40 shares.

- Month 3: The stock price rises to $8 per share. Your $200 investment buys 25 shares.

By the end of Month 3, you have invested a total of $600 and purchased 85 shares. The average price per share over the three months is approximately $7.06.

Comparing Dollar-Cost Averaging with Other Investment Strategies

Key Differences Between DCA and Lump-Sum Investing

Dollar Cost Averaging (DCA) and lump-sum investing are two different ways to invest your money.

With Dollar Cost Averaging (DCA), you invest a fixed amount of money regularly, no matter what the market is doing. For example, you might decide to invest $200 every month in a stock or mutual fund.

On the other hand, lump-sum investing means you put a large amount of money into the market all at once. For instance, you might invest $2,400 in a stock or mutual fund in one big transaction.

The main difference between these two methods is the timing. DCA spreads out your investments over time, making it easier to handle market ups and downs. Meanwhile, lump-sum investing puts all your money into the market at once, which can be riskier if the market isn’t doing well.

| Aspects | Dollar Cost Averaging (DCA) | Lump Sum Investment |

| Investing timing | Invests a fixed amount at regular intervals. | Invests a large amount all at once. |

| Risk of market timing | Reduces risk of poor timing by spreading out investments. | Higher risk if invested right before a market drop. |

| Average cost | Can lower average cost per share in volatile markets. | May result in a higher average cost if invested at a high point. |

| Investment management | Simpler, with regular automatic investments. | Fewer transactions, but requires careful timing. |

| Potential Returns | May underperform in strong bull markets. | Potential for higher returns if invested during a market dip. |

| Cost | May incur higher transaction fees. | Fewer transaction fees, but higher initial investment. |

| Emotional Impacts | Reduces stress by avoiding market timing. | Can be stressful due to timing decisions. |

Let’s compare how Dollar Cost Averaging (DCA) and lump-sum investing have performed in the past.

In rising markets, lump-sum investing usually does better because the whole investment takes advantage of the market going up from the start. Studies show that in strong bull markets, lump-sum investing generally gives higher returns.

However, in volatile or declining markets, DCA can often come out on top. This is because, during market ups and downs or when the market drops, DCA lets you buy more shares when prices are lower, which can lower your overall costs.

Historical data suggests that if the market is steadily going up, lump-sum investing usually gives better returns. But if the market is more unpredictable or going down, DCA might be a better choice. It helps reduce the risk of making bad timing decisions and offers a more favorable return by spreading out your investments.

Ideal Conditions for Dollar-Cost Averaging

Market Conditions That Favor DCA

Dollar Cost Averaging (DCA) works especially well in certain situations:

Volatile Markets

When the market is all over the place, DCA is really helpful. You invest the same amount of money regularly. This means you buy more shares when prices are low and fewer when prices are high. It helps balance out the cost over time, so you don’t end up paying too much when prices are high. Plus, it lowers the risk of making big investments at the wrong time, which can protect you from losing a lot of money.

Bear Markets

During bear markets, when prices are going down, DCA can be a smart move. By keeping up with your regular investments, you take advantage of lower prices. This means you could end up with a lower average cost per share when the market goes back up. As the market recovers, the investments you bought at lower prices can grow more. This might give you better returns in the long run. Plus, sticking with DCA during tough times helps you stay on track. It also keeps you from wanting to stop investing when things look bad.

Uncertain Economic Conditions:

When the economy is unpredictable, DCA helps lower the risk of investing a lot of money at the wrong time. It gives you a steady and disciplined way to invest, even when things are uncertain. By spreading out your investments over time, you avoid putting all your money in when prices might be high. This makes it easier to handle the ups and downs of the market. Plus, DCA helps you stay calm and focused on your long-term goals instead of getting worried about short-term changes.

Types of Investments Suited for DCA

Certain investments work great with the DCA strategy:

Mutual Funds

A lot of mutual funds let you set up automatic investments, which makes them great for DCA. By investing regularly, you can build a mix of different investments over time. With DCA, you’re buying shares of different things regularly, which helps spread out your risk. This means you don’t have to stress about picking the perfect time to invest. Over time, your investments can grow as the different parts of your portfolio do well.

Exchange-traded funds (ETFs)

Just like with mutual funds, you can buy ETFs regularly in small amounts. DCA helps you manage the cost of buying shares in these funds. When you invest the same amount regularly, you get more shares when prices are low and fewer when prices are high. This balances out the cost over time, so it’s less risky than trying to guess the best time to invest. Plus, it’s an easy way to grow your investments without needing a lot of money all at once.

Stocks

For individual stocks, DCA lets you slowly build up your investment in a company. This helps reduce the effect of market ups and downs on your overall investment. When you invest a fixed amount regularly, you buy more shares when the stock price is low and fewer when the price is high. Over time, this can lower the average cost of your shares and make it less risky than buying everything at once when prices are high. It also helps you stick to your investing plan, even when the market is unpredictable.

Retirement Accounts:

DCA is often used in retirement accounts like 401(k)s and IRAs, where you put money in regularly on a set schedule. This strategy works well for long-term retirement savings. By investing regularly, you slowly build up your retirement fund over many years, which helps your money grow through compounding. It also helps you handle market ups and downs better because you’re spreading out your investments over time. Plus, it makes investing simple since you don’t have to worry about picking the perfect time to invest—you just keep saving for the future.

Investor Profiles Who Benefit Most from DCA

DCA is beneficial for different types of investors:

New Investors:

If you’re a beginner who’s unsure about when to invest or nervous about putting a lot of money in all at once, DCA can really help. It gives you a simple plan to follow and takes away the stress of trying to time the market. With DCA, you invest a set amount regularly, so you don’t have to worry about picking the perfect time. This makes it easier to start investing without feeling overwhelmed. Over time, DCA can help you build confidence and grow your investments at your own pace.

Long-Term Investors

People with long-term goals, like saving for retirement, can really benefit from using Dollar Cost Averaging (DCA) to build wealth gradually. By investing a fixed amount of money regularly, they can grow a significant portfolio over time. This strategy allows them to buy more shares when prices are low and fewer shares when prices are high. This helps manage the risk of market ups and downs. DCA also fits well with long-term financial plans because it encourages disciplined investing. It reduces the stress of trying to guess the best time to invest. In the end, this approach can help people reach their financial goals steadily and reliably.

Risk-Averse Investors

If you’re worried about market ups and downs or losing money, DCA can be comforting. By spreading out your investments, you lower the risk of big losses when the market changes. With DCA, you’re not putting all your money in at once, so if the market goes down, you’ve only invested a small amount at that time. This helps keep your overall investment safer from sudden drops. Over time, DCA can help you build a more balanced and steady investment, making it feel less risky.

Regular Income Earners

People who get a regular paycheck can use Dollar Cost Averaging (DCA) to invest part of their income consistently. By setting aside a bit of money from each paycheck for investments, they can slowly build up their portfolio over time. Furthermore, this approach fits well with their regular income, making sure they keep investing without worrying about timing the market. Additionally, it helps them stick to their financial plans and reach their long-term goals.

In summary, DCA is an effective strategy in volatile markets, for certain types of investments, and for various kinds of investors, especially those who are new to investing, have long-term goals, or prefer a steady approach.

Potential Drawbacks and Considerations

Limitations of Dollar Cost Averaging (DCA)

Dollar Cost Averaging (DCA) is a popular investment strategy, but it has some drawbacks. Let’s break them down in a way that’s easy to understand.

Missed Opportunities

Imagine you have some money to invest, and the market is going up steadily. If you use DCA, you spread your investment over time. However, this means you might miss out on bigger gains you could have had if you invested all your money at once when prices were lower.

Long-Term Performance

In a strong bull market, where prices keep rising quickly, DCA might not be the best. Investing a lump sum (all at once) could give you higher returns because you capture the full benefits of the rising prices.

When DCA Might Not Be the Best Strategy

DCA isn’t always the right choice. Here are some situations where it might not work well:

Strong Bull Markets

In a market where prices are consistently rising, lump-sum investing can be more beneficial. By putting a large amount of money in early, you can take full advantage of the ongoing price increases.

Low Transaction Costs

Additionally, if the costs to make transactions are low or nearly zero, DCA might not be as beneficial. In such cases, it might be more efficient and cost-effective to invest a lump sum.

Costs of Frequent Investments

Investing regularly with DCA can also come with some costs:

Transaction Fees

Every time you make an investment, there could be a fee. These fees can add up over time, eating into your overall returns.

Administrative Costs

Some investment accounts charge fees for frequent transactions or require extra paperwork. These administrative costs can also reduce your overall return on investment.

While DCA is great for managing market ups and downs and gradually building wealth, it has its limitations. It’s not always the best strategy. Always consider the market conditions, transaction costs, and your personal investment goals before deciding if DCA is right for you.

Steps to Set Up a Dollar Cost Averaging (DCA) Strategy

Setting up a DCA strategy is pretty straightforward. Here’s how you can do it step by step:

1. Determine Investment Amount: First, decide how much money you want to invest regularly. This amount should fit your budget and help you reach your financial goals. Start with an amount you can manage and stick to it.

2. Choose Investment Intervals: Secondly, decide how often you will invest. Common choices are monthly or quarterly. Pick a frequency that matches your income and your investment goals.

3. Select Investments: Then, choose the investments you want to include in your DCA strategy. This could be mutual funds, ETFs, or individual stocks. Make sure these investments match your risk tolerance and financial goals.

4. Set Up Automatic Contributions: Use your brokerage account or investment platform to set up automatic contributions. Consequently, your chosen amount gets invested at the specified intervals without you having to do it manually each time.

5. Monitor and Adjust: Finally, regularly review your investments and the performance of your DCA strategy. Adjust the investment amount or intervals if needed, based on changes in your financial situation or investment goals.

Tools and Platforms for DCA

Here are some tools and platforms that can help you set up your DCA strategy:

Brokerage Accounts: Most online brokerage accounts let you set up automatic investments. Look for platforms that support regular contributions and offer a variety of investment options.

Investment Apps: Many investment apps, like Robinhood or Betterment, allow you to set up DCA strategies. These apps often have easy-to-use interfaces and tools for managing regular investments.

Retirement Accounts: If you’re investing for retirement, use retirement accounts like 401(k)s or IRAs. These accounts often have built-in options for regular contributions, making DCA easy to implement.

Bank Accounts: Some banks offer investment products with automatic investment options. Check with your bank to see if they provide DCA features.

Practical Tips for Successful Implementation of Dollar-Cost Averaging

To make the most of your DCA strategy, follow these practical tips:

Stay Consistent: Stick to your regular investment schedule. Consistency is key to the success of DCA. Try not to make changes based on short-term market movements.

Review Regularly: Periodically check your DCA strategy and investment performance. Make adjustments if your financial situation or goals change.

Diversify Investments: Make sure your investments are diversified. This helps reduce risk and improve potential returns. Consider a mix of asset types, such as stocks, bonds, and mutual funds.

Be Patient: DCA is a long-term strategy. Be patient and give your investments time to grow. Avoid the temptation to change your strategy based on short-term market fluctuations.

Use Low-Cost Options: Choose investments with low fees to maximize your returns. High fees can eat into the benefits of regular investing.

Historical Case Studies Illustrating DCA Success

The 2008 Financial Crisis

During the 2008 financial crisis, stock markets around the world crashed, and many investors faced huge losses. But those who used a Dollar Cost Averaging (DCA) strategy during this time saw better outcomes.

For example, an investor who started investing $500 monthly in a diversified index fund at the beginning of 2008 bought shares at lower prices. When the market recovered, this investor had a lot of shares bought at reduced prices. As markets rebounded in the following years, their returns were significant. This shows how DCA can help smooth out the impact of market ups and downs and provide long-term gains.

The Tech Bubble of 2000

In the early 2000s, the tech bubble burst, causing tech stock values to drop sharply. An investor who practiced DCA during this time, consistently investing in a tech-focused mutual fund, was able to buy shares at much lower prices. Even though the tech sector faced a tough time, patient investors who continued their regular investments saw considerable growth as the sector bounced back in the following years. This example shows how DCA can help manage the risks of investing in volatile sectors.

Real-Life Examples of Successful Dollar-Cost Averaging

Young Professional Investing for Retirement

Let’s consider Sarah, a young professional who began her career in 2010. Sarah chose to use Dollar Cost Averaging (DCA) to invest $200 monthly into a diversified retirement account. As her early career unfolded, she encountered various economic conditions, including periods of slow recovery and significant market fluctuations.

By sticking to her DCA plan, Sarah bought shares in her retirement fund at different price points. By the time she approached retirement age, her consistent investments had grown significantly. Her disciplined approach to regular investing allowed her to build a substantial retirement portfolio despite economic ups and downs.

College Savings Plan

John and Emma, parents of a young child, started saving for their child’s college education in 2015. They set up a DCA strategy by investing $150 monthly into a college savings plan. Over the years, their regular contributions bought more shares when the market was down and fewer shares when it was up. As their child approached college age in 2035, they discovered that their disciplined approach had built a sizable fund to cover tuition and other expenses. The steady growth of their investment, thanks to DCA, ensured they were well-prepared for the financial commitment to college education.

Investing in Real Estate

Maria, a real estate enthusiast, used a DCA approach to invest in real estate crowdfunding platforms. She invested $500 monthly into various real estate projects, diversifying her portfolio across residential and commercial properties. During economic cycles of expansion and contraction, her regular investments helped her buy shares in properties at different price points. Over time, her investments in diverse real estate projects yielded attractive returns as the properties appreciated in value and generated rental income. Maria’s use of DCA in real estate allowed her to build a diversified property portfolio with reduced market timing risks.

Historical case studies and real-life examples clearly illustrate the effectiveness of Dollar Cost Averaging in various investment scenarios. By spreading out investments over time and sticking to a regular plan, investors can manage risks and take advantage of market fluctuations. Consequently, this approach helps manage risk and build wealth over time.

Summary of Key Points

Dollar Cost Averaging (DCA) is a smart way to invest by spreading out your investments over time. This approach helps reduce the impact of market ups and downs and minimizes the risk of investing all your money at the wrong time. Here are some key points about DCA:

- Lower Average Cost: By investing a fixed amount regularly, you buy more shares when prices are low and fewer shares when prices are high. This helps lower the average cost per share.

- Simplifies Investment Management: DCA makes it easier to manage your investments since you invest the same amount at regular intervals.

- Encourages Disciplined Investing: This strategy encourages you to invest consistently, which is a good habit for building wealth.

DCA works well in various market conditions, including volatile and bear markets. It’s great for different types of investments, like mutual funds, ETFs, and stocks.

Final Thoughts on the Effectiveness of Dollar-Cost Averaging

Dollar-cost averaging is a proven method for managing investment risks and growing your money over time. It lets you invest regularly without worrying about the perfect time to buy. Even though DCA might not give you the highest returns in a strong bull market or when transaction costs are low, it’s still a reliable approach for many investors. Its strengths are in its simplicity, ability to manage market timing risks, and suitability for different investment types and goals. DCA is especially effective for long-term goals, like saving for retirement or college, where steady growth and disciplined investing are important.

Unlock Steady Wealth Growth: Embrace Dollar Cost Averaging Today!

Whether you’re new to investing or have been at it for a while, adding Dollar Cost Averaging to your investment strategy can be really helpful. If you want to reduce the stress of trying to time the market and build a diversified portfolio over time, DCA might be the way to go. It helps smooth out the effects of market fluctuations and encourages you to keep investing regularly.

Start with an amount that comfortably fits your budget, and then set up automatic contributions to make the process even easier. Whether you’re saving for retirement, planning for your child’s education, or investing in various assets, DCA can be a powerful tool to help you steadily reach your financial goals. By embracing this strategy, you can rely on its disciplined approach to work for you as you gradually build wealth over time.