Deciding where to keep your emergency fund is really important because you want to make sure it’s safe and can grow a little over time. An emergency fund is like a financial safety net—it helps you handle unexpected expenses and keeps your finances steady. But here’s the thing: not all savings accounts are the same. To get the most out of your emergency fund, it’s a good idea to choose an account that’s easy to access and still gives you some decent returns. In this guide, we’ll walk through the best places to park your emergency fund, so you can find the right option that fits your needs and gives you peace of mind.

What is an Emergency Fund?

An emergency fund, also known as buffer saving, is like a special savings account that you keep for unexpected expenses, like car repairs or medical bills. Unlike your regular savings or money you might invest, this fund is easy to get to when you need it. But it’s not for planned things like vacations or big purchases. The main goal is to help you stay financially secure during emergencies so you don’t have to borrow money when surprise costs pop up.

Why is an Emergency Fund Important?

Avoiding Debt: Having an emergency fund helps you avoid piling up debt during tough times, saving you money. For example, if you get hit with a $500 medical bill and don’t have savings, you might use a credit card with high interest. That could make the bill much more expensive over time. But with an emergency fund, you can pay it off right away.

Financial Security: A buffer saving is like a safety net for unexpected costs. If your car needs $1,000 in repairs, you can use your funds instead of stressing about borrowing money.

Peace of Mind: Knowing you have savings set aside gives you peace of mind. If you lose your job, your emergency fund can help cover living expenses while you find a new one, so you’re less worried about bills.

Steps to Build an Emergency Fund

1. Set a Savings Goal: It’s smart to save up enough to cover three to six months of living expenses. For example, if you spend ₹30,000 a month, try to save between ₹90,000 and ₹1,80,000 for emergencies.

2. Create a Budget: Keep track of your income and expenses to figure out how much you can save each month. Then, add this savings amount to your budget. For instance, if you earn ₹50,000 a month, you could set aside ₹5,000 regularly for your buffer savings.

3. Open a Separate Savings Account: Choose a separate account just for your emergency fund. Look for one with a good interest rate and no minimum balance. Make sure it’s easy to access but not too tempting to use for non-emergencies.

4. Automate Your Savings: Make saving easy by setting up automatic transfers from your main account to your emergency fund. For example, you could schedule a monthly transfer of ₹5,000 to keep building your savings without even thinking about it.

5. Adjust as Needed: Regularly check your emergency fund and budget. If your income goes up or your expenses go down, consider increasing the amount you save each month to reach your goal faster.

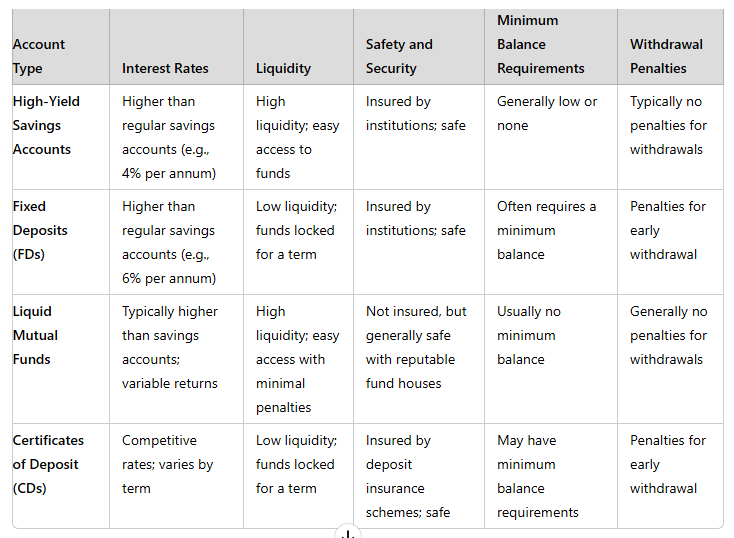

Criteria for Selecting the Right Account For Emergency Fund

1. Liquidity: Liquidity is all about how quickly and easily you can access your money without any trouble. Since emergencies can happen anytime, you need an account where you can withdraw your funds right away, like a high-yield savings account.

2. Interest Rates: Interest rates help your savings grow over time. The higher the rate, the more your money will increase. So, it’s a good idea to compare rates to find the best deal for your emergency fund.

3. Safety and Security: Safety means protecting your money from loss. Pick an account that’s insured, so your savings are secure, like a savings account covered by Deposit Insurance.

4. Accessibility: Accessibility is about how easily you can get to your money when you need it. Look for accounts that let you withdraw funds without penalties or restrictions, such as high-yield savings accounts.

5. Minimum Balance Requirements: Some accounts require you to keep a certain amount of money to avoid fees. Make sure the minimum balance is something you can handle easily without it being too strict.

6. Withdrawal Penalties: Withdrawal penalties are fees you might pay if you take out money before a certain time. For an emergency fund, you want an account with no or very low penalties, so you can use the money whenever you need it.

Choosing the Right Account

1. High-Yield Savings Accounts: These accounts give you better interest rates than regular savings accounts, helping your emergency fund grow faster. For example, an online bank might offer 4% interest compared to 2% from a regular account, meaning more money over time.

2. Fixed Deposits (FDs): FDs let you lock in your money for a set time at a fixed interest rate. They’re safe and offer higher returns than savings accounts but aren’t as easy to access quickly, which might be tricky for emergencies.

3. Liquid Mutual Funds: These funds invest in short-term, safe investments and offer higher returns than savings accounts. They’re great for emergency funds because you can access your money easily without big penalties, though the returns can change a bit.

4. Certificates of Deposit (CDs): CDs are like FDs but offered by banks. They’re safe and can have good interest rates, but the fixed terms and possible penalties for early withdrawal might make them less ideal for emergency funds.

Additional Tips for Maintaining an Emergency Fund

Avoid Using for Non-Emergencies: Only use your emergency fund for real emergencies, so it’s there when you really need it.

Regular Contributions: Keep adding to your emergency fund regularly, even if it’s just a small amount. Every bit helps!

Monitor Interest Rates: Pay attention to the interest rates on your savings account. If you find a better deal, consider switching to earn more on your emergency fund.

Practical Example: Building an Emergency Fund

Let’s take Ananya as an example. She lives in Mumbai and spends ₹30,000 each month on rent, groceries, and other things. Ananya wants to save ₹1,20,000 for emergencies, which covers four months of her expenses.

Here’s what she does:

- Sets a Goal: Ananya decides to save ₹1,20,000.

- Creates a Budget: She finds she can save ₹5,000 every month.

- Opens a High-Yield Savings Account: She picks an account with 4% interest.

- Explores Liquid Mutual Funds: She also puts some money into a liquid mutual fund that offers a 6% return.

- Automates Savings: Ananya sets up an automatic transfer of ₹5,000 each month.

- Reviews Progress: After six months, she checks her progress and increases her monthly savings to ₹7,000 to reach her goal faster.

By doing this, Ananya ensures her emergency fund is safe, easy to access, and growing steadily.

Conclusion

In short, an emergency fund is super important for handling surprise expenses and staying financially stable. By saving some money just for emergencies, you avoid going into debt and feel less stressed about money. This fund lets you cover unexpected costs without messing up your financial plans.

To build your fund, set clear goals and make a budget. Choose a savings account that’s easy to access, has good interest rates, and is safe. Keep adding to it regularly, and check interest rates to get the most out of your savings. Following these steps will give you peace of mind and financial security.

Disclaimer:

The information provided in this document is for educational purposes only and does not constitute financial advice.